大家都知道,ACCA考试的时候学员要学会去理解ACCA考试的内容,同时也需要掌握ACCA考试的关键知识点才可以。ACCA真题练习是帮助学员更好的了解ACCA考试重难点的关键步骤之一,因此ACCA学员在练习的时候要学会去总结,这样才能够更好的掌握并运用ACCA考试的知识点。

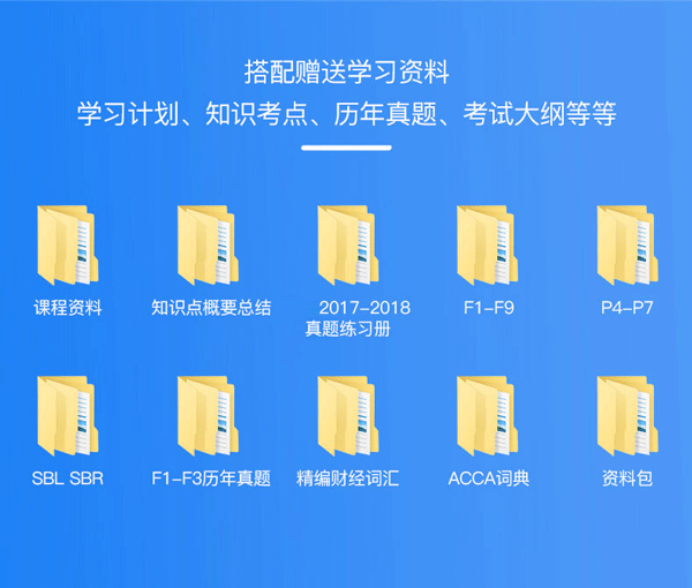

戳:“各科必背定义+历年真题中文解析+20年习题册(PDF版)”

4. [单选题]In 2014 Mr Yuan inherited an estate of RMB2 million from his uncle who had died two months earlier.

A. What is the correct treatment of the estate income for individual income tax purposes?

B. The estate income is not taxable

C. The estate income will be taxed as occasional (ad hoc) income

D. The estate income will be taxed as other income

E. The estate income will be taxed as service income

5. [单选题]10 What would the company’s profit become after the correction of the above errors?

A. $634,760

B. $624,760

C. $624,440

D. $625,240

6. [单选题]19 At 30 June 2004 a company’s allowance for receivables was $39,000. At 30 June 2005 trade receivables totalled $517,000. It was decided to write off debts totalling $37,000 and to adjust the allowance for receivables to the equivalent of 5 per cent of the trade receivables based on past events.

What figure should appear in the income statement for these items?

A. $61,000

B. $22,000

C. $24,000

D. $23,850

7. [单选题]Hindberg is a car retailer. On 1 April 2014, Hindberg sold a car to Latterly on the following terms:

A. Latterly paid $12,650 (half of the cost) on 1 April 2014 and would pay the remaining $12,650 on 31 March 2016 (two years after the sale). Hindberg’s cost of capital is 10% per annum.

B. What is the total amount which Hindberg should credit to profit or loss in respect of this transaction in the year ended 31 March 2015?

C. $23,105

D. $23,000

E. $20,909

F. $24,150

4、正确答案 :B

5、正确答案 :D

解析:630,000 – 4,320 – 440

6、正确答案 :B

7、正确答案 :F

解析:At 31 March 2015, the deferred consideration of $12,650 would need to be discounted by 10% for one year to $11,500 (effectively deferring a finance cost of $1,150). The total amount credited to profit or loss would be $24,150 (12,650 + 11,500).

了解更多有关ACCA考试相关资讯,在线咨询老师或者添加融跃老师微信(rongyuejiaoyu)!另外还可以领取免 费备考资料哦!