大家都知道,要想更好的掌握财会知识的内容,就应该重视ACCA考试的每一个知识点的学习,通过学习来填充财会知识的空白。ACCA考试的内容有很多,学员该怎么去学习?怎么理解ACCA考试Advantages of swap的内容?

ACCA考试Advantages of swap是学员需要学习并掌握的知识点 ,在备考ACCA考试的时候,学员需要更好的去理解知识点的内容才可以。

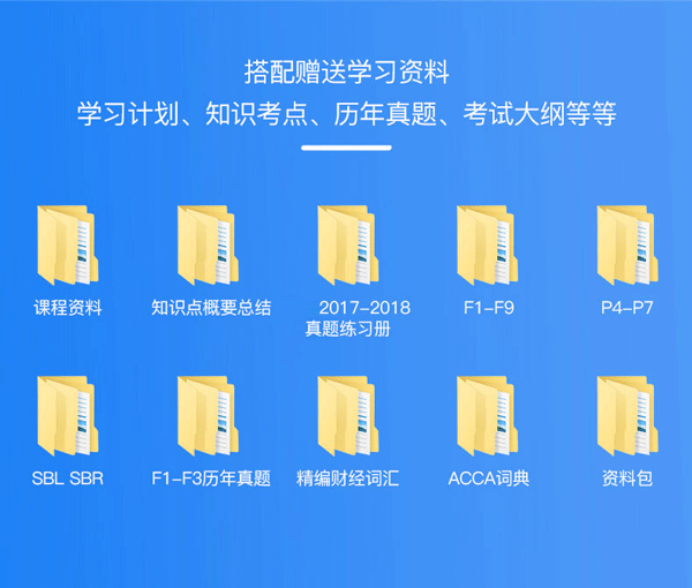

戳:“各科必背定义+历年真题中文解析+20年习题册(PDF版)”

Why not terminate the original borrowing? – Saving transaction costs (termination fee, issue cost). A bank normally arranges the swap and charge an arrangement fee, which is much lower than transaction cost.

Swaps can be used to hedge against an adverse movement in interest rates. Say a company has a £200m floating loan and the treasurer believes that interest rates are likely to rise over the next five years. He could enter into a five-year swap with a counter party to swap into a fixed rate of interest for the next five years. From year six onwards, the company will once again pay a floating rate of interest.

A swap can be used to obtain cheaper finance. A swap should result in a company being able to borrow what they want at a better rate under a swap arrangement, than borrowing it directly themselves.

ACCA知识点的学习是帮助学员更好掌握ACCA的基本知识点,如果学员还有更多想要学习的内容,可以在线咨询老师或者添加老师微信(rongyuejiaoyu)。